Florida's tax system is like that friend who seems perfect until you realize they're secretly charging you for every soda they grab from your fridge. Sure, there's no state income tax (cue the champagne), but the Sunshine State has plenty of other ways to collect its share. Whether you're a new resident, business owner, or just trying to figure out why everything costs more than the price tag says, understanding Florida's tax structure can save you serious money.

Sales tax: The silent wallet drainer

Florida's sales tax is the state's bread and butter, or more accurately, its luxury yacht and gator repellent. The base state rate sits at 6%, which sounds reasonable until you realize that's just the beginning of the story.

Counties love to pile on their own discretionary surtaxes like toppings on a pizza nobody ordered. These extra charges range from absolutely nothing in Collier County (bless their hearts) to a full 1.5% in certain areas. Most Florida counties add 1% to the base rate, bringing your total to 7%. If you're shopping in Miami-Dade, Broward, or most other populous counties, expect to pay that full 7% on nearly everything that isn't nailed down.

The good news? Florida exempts most groceries, prescription medications, and medical equipment from sales tax. Recent legislation even added baby products, diapers, and over-the-counter medications to the exemption list. Because nothing says "welcome to parenthood" like tax-free diapers at 3 AM.

Sales tax holidays: Christmas in August (and other months)

Florida's sales tax holidays are like Black Friday without the wrestling matches over flat-screen TVs. The state offers several throughout the year:

- Back-to-school holiday (August 1-31)

- Disaster preparedness supplies (year-round)

- Energy Star appliances (specific periods)

- Tools and work equipment

- Children's books and toys

- Outdoor recreation items

The back-to-school holiday is the granddaddy of them all, lasting the entire month of August. Clothing under $100, school supplies under $50, and computers under $1,500 all become tax-free. Parents across Florida collectively save enough to maybe afford one college textbook.

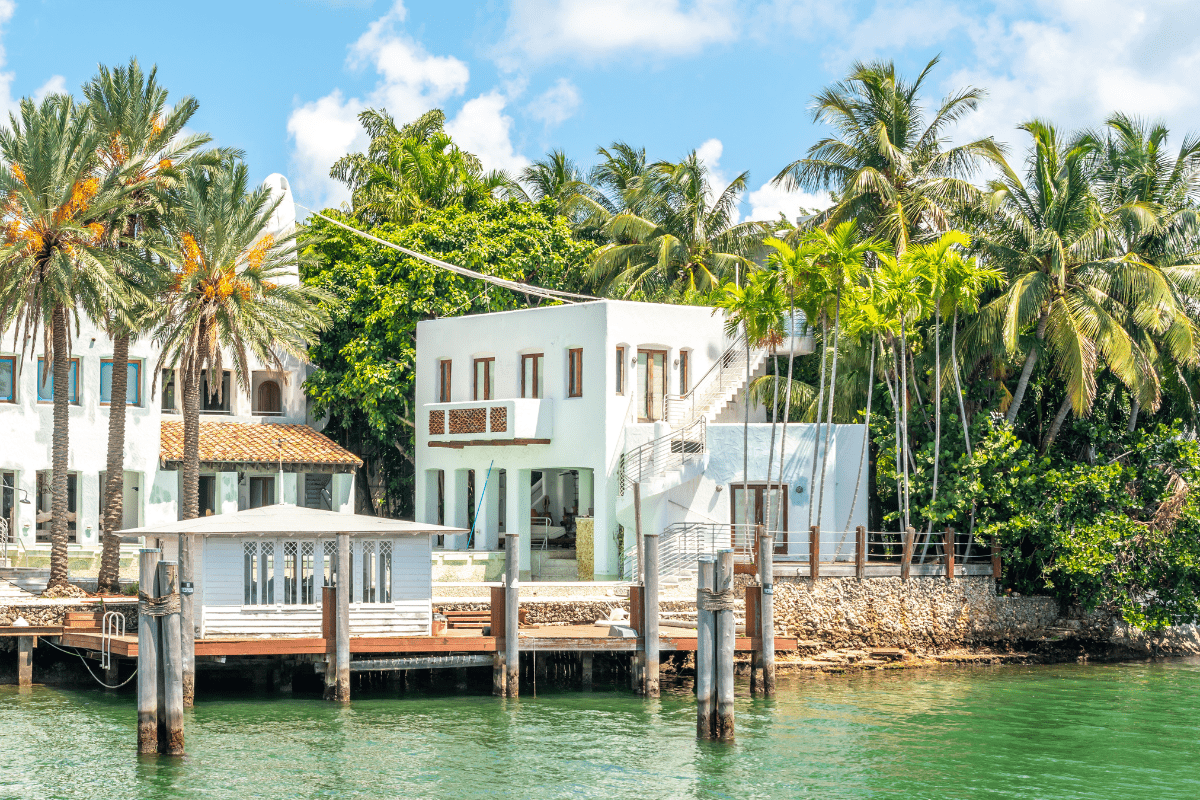

Property taxes: Your home's annual subscription fee

Despite having no state property tax, Florida still manages to extract a healthy sum from homeowners through local taxes. The average effective rate hovers around 0.82%, which beats the national average of 0.99%. But don't start celebrating yet – that percentage can vary wildly depending on where you plant your flamingo lawn ornaments.

The homestead exemption: Your new best friend

Florida's homestead exemption is like a superhero cape for your primary residence. It knocks up to $50,000 off your home's assessed value, with the first $25,000 exempt from all property taxes and the second $25,000 exempt from non-school taxes. For most homeowners, this translates to about $800 in annual savings – enough for a decent hurricane supply kit or a really nice dinner where you complain about property taxes.

The Save Our Homes cap adds another layer of protection, limiting annual assessment increases to 3% or the Consumer Price Index, whichever is lower. In 2025, that cap is 2.9%, preventing long-term residents from being taxed out of their homes when their neighbor sells to a tech entrepreneur for three times the original price.

Special exemptions that actually matter

Seniors aged 65 and older with household incomes below $36,745 can score an additional $50,000 exemption. Combined with the standard homestead exemption, that's $100,000 off your assessed value. It's like Florida's way of saying "thanks for not moving to Arizona."

Veterans get their own set of perks:

- 10% disability: $5,000 exemption

- 100% permanent disability: Complete exemption

- Combat-disabled over 65: Percentage discount

- Surviving spouses: Benefits continue

Pay early, save money (revolutionary concept)

Florida rewards procrastination's mortal enemy with property tax discounts for early payment. Pay in November and get 4% off. December drops to 3%, January to 2%, and February squeaks in at 1%. By March, you're paying full price like a tourist at Disney World. Miss the March 31 deadline, and you'll face penalties that would make a loan shark blush.

Business taxes: Where corporations play hide and seek

Florida's approach to corporate income tax is fascinating. The state charges a flat 5.5% rate on net income after a $50,000 exemption, yet somehow 99% of Florida businesses pay absolutely nothing. How? Simple – the tax only applies to C corporations and certain other entities. If you're a sole proprietorship, partnership, standard LLC, or S corporation, you're off the hook entirely.

This explains why Florida has more LLCs than palm trees (slight exaggeration). Smart business owners structure their companies to avoid this tax entirely, leaving mostly large corporations and out-of-state businesses to foot the bill.

Documentary stamps: The real estate surprise

Every real estate transaction in Florida comes with a side of documentary stamp taxes. Property sales trigger a $0.70 per $100 tax statewide, except in Miami-Dade where single-family homes pay $0.60 per $100. On a $400,000 home, that's $2,800 in stamps – enough to make you wonder if they're made of gold.

Mortgages get hit too, at $0.35 per $100. That $300,000 mortgage you're so excited about? Add another $1,050 to your closing costs. It's like paying a cover charge to join the homeowner's club.

Commercial rent tax goes extinct

In a plot twist worthy of a Florida Man headline, the state is eliminating its commercial rent tax effective October 1, 2025. Florida was the only state weird enough to tax commercial rent in the first place, so this is less "groundbreaking reform" and more "finally joining the rest of the country."

The current 2% rate (already reduced from 4.5%) generated about $2.5 billion annually. Critics argue the elimination primarily benefits large commercial property owners, while supporters claim it'll make Florida more business-friendly. Either way, it's the largest tax cut in recent Florida history, which is saying something in a state that loves tax cuts like gators love swamps.

The specialty tax collection

Beyond the headliners, Florida collects an impressive array of specialized taxes that would make a stamp collector jealous.

Tourist development tax: Making visitors pay for paradise

Hotels and short-term rentals face tourist development taxes ranging from 2% to 7% on top of regular sales tax. Miami Beach leads the pack with a combined 14% tax on hotel stays. That $200 room suddenly costs $228, but hey, someone has to pay for all that beach sand replacement.

Communications services tax: Your phone bill's mystery charge

The communications services tax combines a 4.92% state tax with 2.52% in gross receipts taxes, plus local rates that create 481 different rate combinations statewide. It's like a tax turducken – a tax stuffed inside another tax, wrapped in yet another tax.

Sin taxes: Pay to play

Florida's sin taxes are surprisingly moderate by national standards:

- Cigarettes: $1.34 per pack

- Beer: $0.48 per gallon

- Wine: $2.25-$3.50 per gallon

- Spirits: $6.50-$9.53 per gallon

- Vaping products: Zero (party on)

Comparing Florida to everywhere else

Florida consistently ranks among the most tax-friendly states, placing 4th in competitiveness nationally. But here's the plot twist – it's also the most regressive tax system in America.

Low-income residents pay 13.2% of their income in state and local taxes, while the top 1% pay just 2.7%. It's like a reverse Robin Hood situation, except instead of stealing from the rich, we're just asking the poor to pay for everything at the register.

No-income-tax state showdown

Among states without income tax, Florida holds its own:

- Property taxes: Florida (0.82%) beats Texas (1.68%)

- Sales taxes: Florida (7%) beats Washington (9.38%)

- Overall burden: Florida wins with style

The retiree advantage

For retirees, Florida is basically tax heaven with better weather. No taxes on:

- Social Security benefits

- Pension income

- 401(k) distributions

- IRA withdrawals

- Investment income

A retiree with $80,000 in annual income saves $3,000-6,000 compared to income-tax states. High-income retirees pulling in $500,000+ save enough to buy a small yacht. Or a large yacht. It's Florida.

Money-saving strategies that actually work

Understanding Florida's tax system is nice, but using it to save money is better. Here's how to keep more cash in your pocket:

First, claim every property tax exemption available. File for homestead exemption by March 1st, investigate senior and veteran exemptions, and always pay property taxes in November for the maximum 4% discount. Use Save Our Homes portability when moving within Florida – those accumulated benefits are like loyalty points, but actually valuable.

Time major purchases around sales tax holidays. That new laptop for school? Buy it in August. Hurricane supplies? Year-round exemptions have you covered. Planning a home improvement project? Check if your supplies qualify during tool holidays.

For business owners, structure wisely. Choose an LLC or S-Corporation to avoid the 5.5% corporate income tax entirely. After October 2025, reassess whether owning or leasing commercial property makes more sense without the rent tax. Don't forget to claim your $25,000 tangible property exemption – it's free money.

Part-time Florida residents need bulletproof documentation. Get a Florida driver's license, register to vote, and spend at least 183 days annually in-state. Your former state will likely challenge your residency change, especially if you're high-income. Keep meticulous records of everything from grocery receipts to golf scorecards.

The bottom line on Florida taxes

Florida's tax system is a paradox wrapped in a contradiction, deep-fried in irony. It's simultaneously one of the most tax-friendly states for retirees and high earners while imposing the nation's most regressive structure on working families. The absence of income tax creates clear winners – anyone with substantial income keeps more of it. But the heavy reliance on consumption taxes means lower-income residents pay a higher percentage of their earnings just to exist.

Whether Florida's tax structure works for you depends entirely on your situation. Retirees living on pensions and Social Security? You've hit the jackpot. High-income remote worker? Welcome to paradise. Working family trying to make ends meet? Well, at least the beaches are free. Understanding these taxes won't change them, but it might help you navigate them better – and maybe save enough for an extra margarita or two.