Starting a business in Michigan might sound about as exciting as watching paint dry in January, but here's the thing: the state just hit its highest business ranking ever. With some of the lowest startup costs in the nation and a new online system that actually works (shocking, I know), Michigan is quietly becoming the Midwest's best-kept entrepreneurial secret.

Understanding Michigan's business landscape

Let me paint you a picture that doesn't involve lakes or cars for once. Michigan just landed at number six nationally in CNBC's Top States for Business rankings, which is like your perpetually C-student kid suddenly making honor roll. The state sits at number four for cost of doing business, and here's the kicker: you don't need a general state business license to get started.

That's right. While other states make you jump through hoops like a circus poodle, Michigan basically says "cool, just register your business and get to work." The new online filing system launching June 23, 2025, promises to make things even smoother, though I'll believe it when I see a government website that doesn't crash during peak hours.

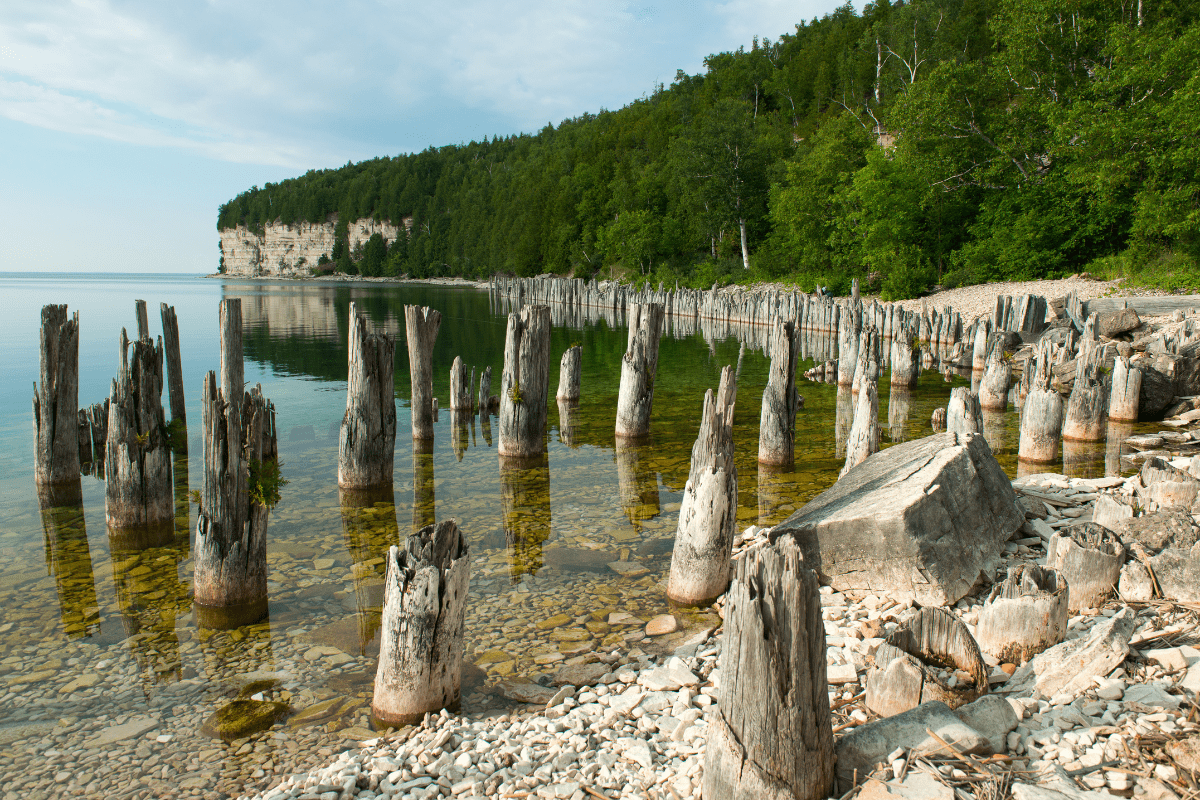

The real story here is what's happening on the ground. Michigan's manufacturing sector contributes a whopping $99.2 billion to the state GDP, and it's not just about cars anymore. The state is diversifying into clean energy, defense tech, and other sectors faster than you can say "economic diversification." Plus, with 3,288 miles of Great Lakes coastline and sitting within 500 miles of half the U.S. and Canadian population, the logistics advantages are hard to ignore.

Of course, it's not all sunshine and Vernors. The state's dealing with some population challenges, with projections showing a decline to 9.9 million by 2050. The unemployment rate hit 5.4% in May 2025, above the national average of 4.2%. But hey, at least the cost of living is 17.3% lower than Chicago, so your startup dollars stretch further while you figure things out.

Choosing your business structure

Before you start printing business cards, you need to decide what kind of business entity makes sense. Think of it like choosing a car: you could get the reliable sedan (LLC), the fancy sports car (corporation), or just walk everywhere (sole proprietorship). Each has its perks and quirks.

Limited Liability Company (LLC)

The LLC is Michigan's Honda Civic of business structures: reliable, affordable, and gets the job done. For a mere $50 filing fee, you get personal liability protection and tax flexibility. You'll file Articles of Organization (Form 700), pick a name that ends with LLC, and designate a registered agent with a Michigan address.

The best part? No publication requirements like some states that make you announce your business in the newspaper like it's 1952. Annual compliance involves filing a statement by February 15 with a $25 fee. Miss the deadline and you'll pay $10 monthly late fees up to $75 total, which is still cheaper than one fancy coffee habit.

Corporation options

If you're thinking bigger or planning to court investors, a corporation might be your jam. The base filing fee starts at $10, but here's where it gets interesting: you'll pay additional fees based on your authorized shares, ranging from $50 to over $1,000. It's like ordering a burger and finding out the bun costs extra.

Corporations require more formalities:

- Articles of Incorporation (Form 500)

- Corporate bylaws

- Annual shareholder meetings

- Board of directors

- Stock certificates

The annual report is due May 15 with a $25 fee. S-Corporation election happens at the federal level, and Michigan automatically recognizes it, which is refreshingly simple.

Sole proprietorship simplicity

Sometimes the simplest path is the best path. Sole proprietorships require zero state filing and zero fees. You literally just start doing business. If you want to operate under anything other than your legal name, you'll need to file a Certificate of Assumed Name at the county level for about $10 to $25.

The downside? You and your business are legally the same entity, meaning your personal assets are on the line if someone sues your business. It's like going into battle without armor: brave but potentially foolish.

Step-by-step registration process

Now for the fun part: actually registering your business. The process is surprisingly straightforward, assuming you don't get distracted by cat videos halfway through.

Preparing your paperwork

First, check if your desired business name is available through Michigan's online search tool. Pro tip: have three backup names ready because your first choice "Awesome Sauce Industries LLC" is probably taken. Your name needs to be distinguishable from existing businesses and include the appropriate designation (LLC, Inc., etc.).

Next, you'll need a registered agent with a Michigan street address. This can't be a P.O. box, and yes, it can be you if you have a Michigan address. The registered agent receives legal documents on your business's behalf, so pick someone reliable who actually checks their mail.

Filing with the state

Head to michigan.gov/corpfileonline to file online. The system walks you through the process, and standard processing takes 10 business days. If you're in a hurry, expedited options include:

- 24-hour service: $50-100

- Same-day service: $100-200

- 1-hour service: $1,000

That last one is for when you really, really need to impress someone at a cocktail party tonight.

Post-filing requirements

Once Michigan approves your filing, you're not quite done. You'll need an Employer Identification Number (EIN) from the IRS, which is free and instant online. Think of it as your business's Social Security number, except the IRS won't call you about your car's extended warranty.

If you have an LLC, draft an operating agreement even though Michigan doesn't require it. Future you will thank present you when disputes arise. Corporations need bylaws and should hold an organizational meeting to elect directors and officers. Document everything because memories are unreliable and courts love paper trails.

Navigating Michigan taxes

Taxes in Michigan are like a potluck dinner: everyone brings something different to the table, and you need to keep track of who wants what.

State tax obligations

Michigan's Corporate Income Tax sits at 6%, but small businesses get a sweet deal with the alternative credit reducing the rate to just 1.8% on adjusted business income. If your gross receipts are under $350,000 or your annual tax liability is under $100, you're completely exempt. It's like Michigan saying "we know you're broke, come back when you're making real money."

The state sales tax is a flat 6% statewide with zero local additions. This is huge compared to states where every county, city, and hamlet adds their own percentage. Economic nexus kicks in at $100,000 in sales or 200 transactions annually. Registration is free through Michigan Treasury, and they'll tell you how often to file based on your expected tax liability.

For employers, unemployment insurance rates range from 0.06% to 10.3% on the first $9,000 of wages (down from $9,500 in 2024). New non-construction employers pay 2.7%, which is like the middle seat on an airplane: not great, but could be worse.

Local tax considerations

Here's where things get spicy. Twenty-four Michigan cities impose their own income taxes. Most charge 1% for residents and 0.5% for non-residents, but Detroit, Grand Rapids, Highland Park, and Saginaw decided to be special with higher rates.

Property taxes average 1.24% statewide but vary wildly by location. Luce County averages $1,048 annually while Washtenaw County hits $5,255. It's like comparing rent in rural Kansas to Manhattan, except with more snow.

Money-saving tax incentives

Michigan's rolling out incentives like a clearance sale. The new R&D tax credit program offers up to $2 million annually for large businesses and $250,000 for small businesses. Renaissance Zones provide near-complete tax exemption for up to 15 years in designated areas.

The PA 198 program gives industrial facilities 50% property tax abatements for up to 12 years. Small businesses with under $80,000 in personal property get complete exemption. Manufacturing equipment placed after 2012 gets additional breaks. It's like Michigan really wants you to make stuff here.

Understanding licensing requirements

Remember when I said Michigan doesn't require a general business license? That's true, but specific industries need various permits and licenses. It's like saying you don't need a license to walk, but you do need one to drive.

Professional licensing needs

The state regulates 26 health professions through LARA's Bureau of Professional Licensing. Renewal cycles run 2-3 years with continuing education requirements that ensure your doctor knows TikTok isn't a valid medical reference.

Construction contractors need residential builder or maintenance licenses, requiring 60 hours of education plus passing an exam. Total cost runs around $700, which seems steep until you realize unlicensed contractors are why your neighbor's deck looks like modern art.

Food establishments register through MDARD with annual fees from $125 to $800 based on size. All licenses expire April 30, requiring 30-day advance applications. Missing the deadline means explaining to customers why the health department shut you down.

Local licensing variations

Local requirements are where things get interesting, and by interesting, I mean potentially confusing. Detroit requires licenses for specific categories:

- Amusement businesses: $300-500

- Motor vehicle services: $200-400

- Gas stations: $500-800

Processing takes 2-4 weeks through their electronic system, which is progress considering it used to involve carrier pigeons.

Sterling Heights mandates general business licenses for everyone at $50-300 annually. Grand Rapids only licenses specific operations like food trucks ($150) and home-based businesses ($50). It's like each city decided to be a unique snowflake with licensing requirements.

Most municipalities require zoning compliance before licensing. Home-based businesses typically need permits ($25-100) with restrictions on signage, client visits, and employees. Nobody wants their residential street turning into a commercial district.

Funding and support resources

Starting a business without money is like trying to bake a cake without ingredients. Fortunately, Michigan offers more funding options than a college student has excuses for missing class.

Free business assistance programs

The Michigan Small Business Development Center (SBDC) is basically free consulting on steroids. With 10 regional offices, they offer:

- Business plan development

- Financial analysis

- Market research

- Multiple language support

It's like having a business advisor without the hourly rate that makes you cry.

SCORE Michigan chapters match you with experienced mentors who've been there, done that, and got the bankruptcy papers to prove it (kidding, mostly). These volunteers provide guidance on everything from startup basics to growth strategies.

State funding programs

The Michigan Economic Development Corporation runs multiple funding programs:

- Microloans up to $50,000

- Pre-Seed Fund III: $100K-$250K

- State Small Business Credit Initiative: $236.9 million

The Michigan startup ecosystem is surprisingly robust, with 96.4% of startups backed by local venture investors. Detroit's startup scene ranks number two globally for growth, which is like finding out your quiet cousin is secretly a rock star.

Making the most of resources

Success stories show what's possible when you actually use these resources. SkySpecs grew from startup to robotic wind turbine maintenance leader. Workit Health's telemedicine platform doubled traditional substance abuse treatment success rates. These aren't overnight success stories but examples of leveraging available support effectively.

The key is starting early. Don't wait until you're desperate to seek help. SBDC consultants are most effective when you're planning, not panicking. Think of them as business therapists: better for prevention than crisis management.

Your 12-week launch timeline

Launching a business is like planning a wedding: everything takes longer than expected, something will go wrong, and you'll spend more than budgeted. Here's a realistic timeline that won't have you crying into your coffee.

Weeks 1-4: Laying the foundation

Start with validating your business idea using SBDC's free market research. "Build it and they will come" worked for Kevin Costner, not for your artisanal sock puppet business. Choose your business structure based on liability needs and tax implications. LLCs work for most, but consult an attorney if you're unsure.

Register with LARA after checking name availability. File your formation documents with the appropriate fee ($50-60 for most). Don't procrastinate because good names disappear faster than donuts at a police station.

Weeks 3-6: Legal and tax setup

Obtain your federal EIN online instantly and free. Register for Michigan taxes through Treasury Online, including sales tax if selling tangible goods. Research required licenses using Michigan's License Search tool. Each city has different requirements, so check both state and local needs.

Set up your business banking immediately. Mixing personal and business funds is like mixing plaids and stripes: technically possible but professionally inadvisable. Open a dedicated business checking account and maybe a savings account for tax reserves.

Weeks 5-8: Operational essentials

Implement accounting systems from day one. QuickBooks is SBDC-recommended, but any system beats a shoebox full of receipts. Secure appropriate insurance including general liability and workers' comp if hiring. Insurance seems expensive until you need it, then it seems priceless.

If you need physical space, ensure zoning compliance before signing leases. Nothing ruins your day like discovering your perfect location is zoned residential-only. Work with local planning departments early to avoid costly surprises.

Weeks 7-12: Launch preparation

Develop marketing materials and build your online presence. In 2025, not having a website is like not having a phone number. Join relevant chambers of commerce and professional associations. Networking is just making friends with business benefits.

Finalize vendor relationships and supply chains. Build in buffer time because suppliers' definition of "two weeks" rarely matches yours. Test all systems before officially launching. Better to find problems during soft launch than on opening day.

Conclusion

Starting a business in Michigan offers genuine advantages: low costs, solid support systems, and a state government that's actually trying to help rather than hinder. Yes, there are challenges like population trends and higher unemployment, but the fundamentals are strong.

The key to success is leveraging available resources early and often. Michigan's business community is surprisingly collaborative, probably because we all bond over surviving winters. Use the SBDC, find a SCORE mentor, and take advantage of tax incentives. Most importantly, remember that every successful Michigan business started exactly where you are now: excited, slightly terrified, and ready to build something great.